Expats often need a digital bank that keeps international fees low.

The Revolut App offers fast transfers, real exchange rates, and straightforward pricing across countries.

This review examines whether the Revolut App is the best choice for expats seeking affordable, convenient banking.

What Revolut Is and Who It’s For

Revolut is a digital banking app that lets you hold, send, and spend money in multiple currencies.

It focuses on low fees, fast transfers, and simple account management for global users.

Here is who the app is for:

- Expats who need low-cost international banking

- Travelers who want real exchange rates abroad

- Freelancers who get paid in different currencies

- Remote workers who manage global income

- Students living or studying in another country

Account Types and Plans

Revolut offers different account plans so you can choose the features and fees that fit your needs.

Each plan includes core banking tools, but higher tiers add more limits and extra benefits. Here are the account types and plans:

- Standard – Free plan with basic transfers, card payments, and limited ATM withdrawals.

- Plus – Low monthly fee with better support and higher limits than Standard.

- Premium – Mid-tier plan with no-fee FX during weekdays, higher ATM limits, and travel perks.

- Metal – Highest tier with the best limits, cashback, priority support, and exclusive benefits.

International Money Transfers

International transfers are one of the main reasons expats use the Revolut App. The app keeps the process simple, fast, and cheaper than most traditional banks.

Here are the key points about international money transfers:

- Supports over 30+ currencies for global transfers.

- Uses real exchange rates during weekdays.

- Sends money instantly between Revolut users.

- Offers bank transfers that usually arrive within minutes or hours.

- Charges FX markups on weekends or for certain currencies.

- Adds limits depending on your plan (Standard, Plus, Premium, Metal).

Fees Expats Must Know

Revolut’s fee structure is an essential factor for expats who rely on frequent transfers and overseas spending.

Understanding these charges makes it easier to manage costs while living abroad.

Monthly Plan Fees:

- Standard (€0), Plus (about €3 3/month), Premium (about €8 8/month), Metal (about €14/month).

International Transfer Fees:

- Usually €0–€1 for standard transfers; some currencies may incur a small extra fee depending on the region.

FX Markups:

- 0.5% markup for Standard users after exceeding the free monthly allowance.

- 0% markup on weekdays for Premium and Metal.

- Weekend markup: typically 1% on all plans for currency exchanges done Saturday–Sunday.

ATM Withdrawal Fees:

- Standard: Free up to €200/month, then 2% fee.

- Premium: Free up to €400/month, then 2% fee.

- Metal: Free up to €800/month, then 2% fee.

Cash Withdrawal Markups:

- Some currencies incur an extra 0.5%–1% due to local banking rules.

Card Replacement Fees:

- Around €6–€10, depending on the delivery country.

Express Delivery Fees:

- Usually €12–€20 if you want the card shipped urgently.

Real Exchange Rates and FX Markups

Revolut applies clear rules to exchange rates, which helps expats understand when conversions are free and when extra charges apply.

The app uses market rates most of the time, but some markups appear depending on the day and plan.

Here are the details on real exchange rates and FX markups:

- Uses the real mid-market rate on weekdays for most currencies.

- No weekday FX markup for Premium and Metal plans.

- Standard and Plus users get real rates but may pay a 0.5% markup after their free allowance.

- The weekend FX markup applies to all plans, typically around 1%.

- Higher markups apply to exotic currencies like THB and UAH.

- Large transfers may incur a small additional fee, depending on currency liquidity.

ATM Withdrawals Abroad

ATM withdrawals are essential for expats who need cash in different countries.

Revolut sets clear limits and fees based on your plan, which helps you control costs while traveling or living abroad.

Here are the key points about ATM withdrawals abroad:

- Standard plan: Free up to €200/month, then 2% fee on additional withdrawals.

- Plus plan: Similar free limit to Standard, with the same 2% fee after the limit.

- Premium plan: Free up to €400/month, then a 2% fee applies.

- Metal plan: Free up to €800/month, then 2% fee.

- Cash withdrawal FX markup: Extra 0.5%–1% may apply for certain currencies.

- Local ATM operator fees: Some machines charge their own fee, which Revolut cannot remove.

Card Payments and Overseas Spending

Card payments abroad are one of the strongest features of the Revolut App.

The app keeps overseas spending simple by using automatic currency conversion and clear fees.

Here is the information on card payments and overseas spending:

- Automatic currency conversion using real weekday exchange rates.

- No foreign transaction fees on most purchases.

- Weekend FX markup of about 1% when paying in a foreign currency.

- Premium and Metal offer better FX terms and fewer limits.

- Contactless, chip, and mobile payments are supported in most countries.

- Real-time spending notifications to track international purchases.

Safety and Security

Revolut offers strong security tools to protect your account across different countries.

The app gives you control over your card and payments so you can manage your money safely.

Here is the list for safety and security:

- Instant freeze and unfreeze for your physical card.

- Virtual cards for safer online shopping.

- Single-use cards to prevent online fraud.

- Biometric login with fingerprint or face ID.

- Real-time alerts for every transaction.

- Location-based protection to block unusual card activity.

- Encrypted data and transfers that meet banking security standards.

Pros and Cons for Expats

Revolut gives expats several strengths but also has a few limitations that matter when living abroad.

This section shows both sides so you can decide how well the app fits your daily needs.

- Real weekday exchange rates with no hidden spreads.

- Low-cost international transfers in many currencies.

- Fast account setup with simple verification.

- Multi-currency balance support for global spending.

- Strong security features, such as card-freeze and virtual cards.

- Smooth overseas payments with instant notifications.

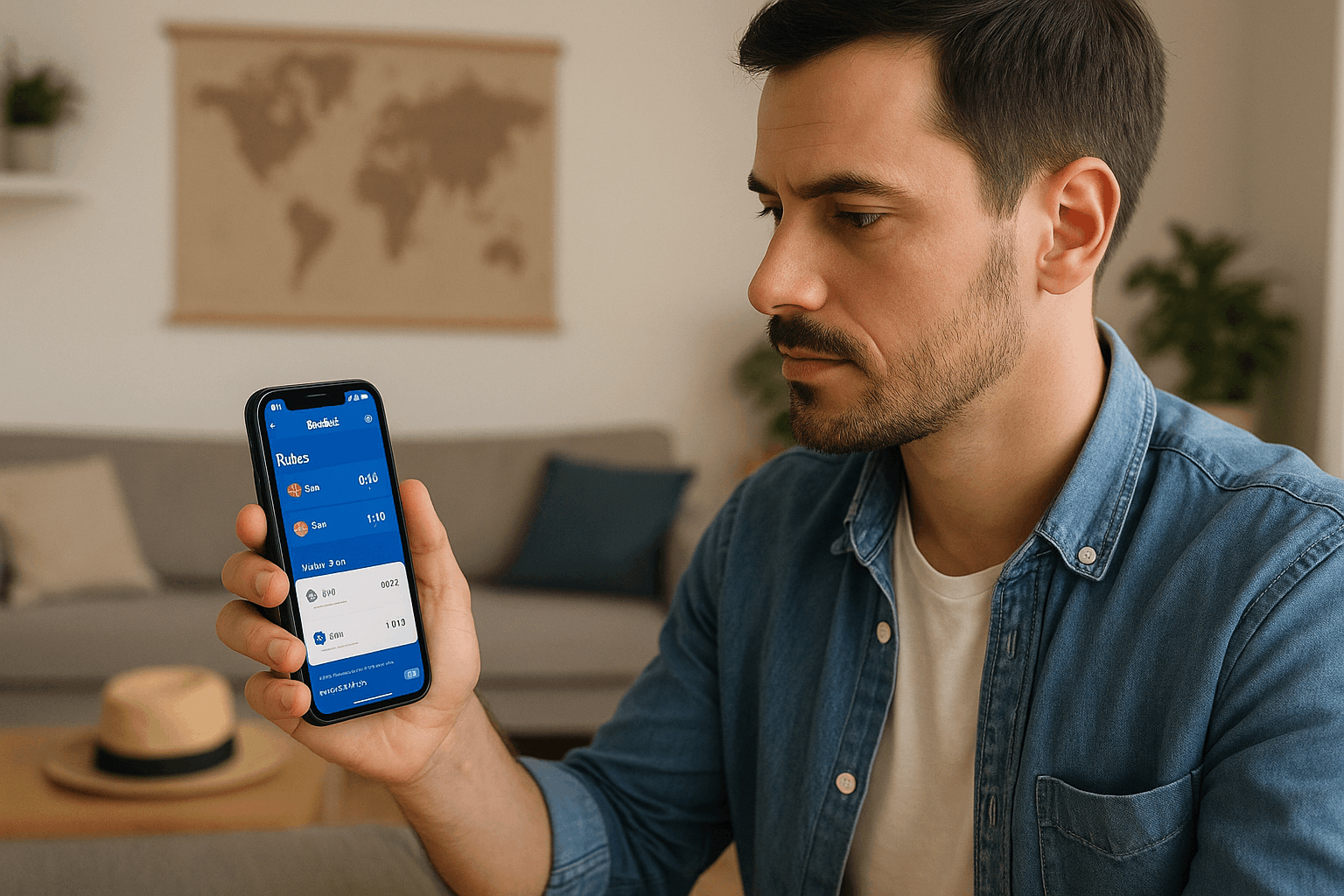

How to Download the App

Downloading the Revolut App is the first step before creating your account. The process is fast and works on any modern smartphone.

- Open the App Store or Google Play on your device.

- Search for “Revolut App.”

- Select the official app published by Revolut Ltd.

- Tap Install and wait for the download to finish.

- Open the app to begin setup.

How to Open a Revolut Account

Opening a Revolut account takes only a few minutes because everything happens inside the app.

You complete basic details and verify your identity to activate your account.

- Enter your phone number to create your profile.

- Enter your personal details, such as your name, address, and date of birth.

- Verify your identity by scanning your ID and taking a selfie.

- Set a passcode for secure access.

- Choose your plan (Standard, Plus, Premium, or Metal).

- Add money using a bank card or transfer to activate the account.

To Conclude

Revolut gives expats a practical way to manage money across countries with low fees and fast transfers.

The app keeps international spending simple through real exchange rates and clear limits.

Download the Revolut App today and see if it fits your daily needs abroad.

Disclaimer

All fees, limits, and features mentioned in this article may vary by country and plan.

Always check the official Revolut App or website for the most up-to-date information before making any decision.