Zelle lets you send and receive money instantly, but that convenience also attracts scammers.

Many users fall for fake messages or fraud attempts that appear real.

These Zelle safety tips will help you protect your account and keep your money secure.

Understanding Zelle and How It Works

Zelle makes money transfers fast and simple. But knowing how it functions helps you use it wisely and avoid mistakes. Here’s what you should know:

- Instant Transfers: Send money instantly between linked bank accounts within minutes.

- No Reversal Option: Payments can’t be canceled once sent, so double-check before confirming.

- Bank Integration: Available in most major U.S. banks and credit unions through mobile apps.

- Recipient Verification: You only need an email or phone number—always confirm accuracy.

- Limited Protection: Zelle doesn’t offer refunds or purchase protection for wrong transfers.

- Best Use Case: Ideal for trusted contacts, not for paying unknown buyers or sellers.

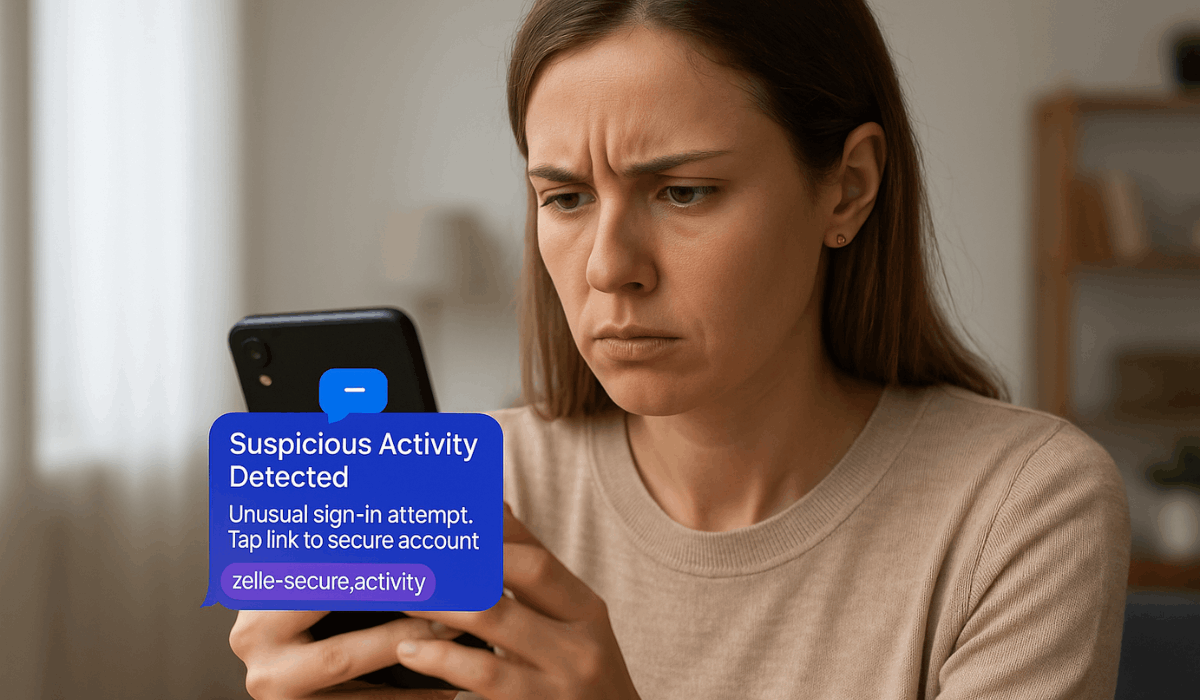

Common Zelle Scams You Should Know

Scammers use many tactics to trick users into sending money or sharing account details.

Knowing how these scams work helps you avoid costly mistakes. Here are the most common ones to watch for:

- Impersonation Scams: Fraudsters pose as bank staff or Zelle support and ask for verification codes or personal info.

- Fake Bank Alerts: You get a text or email claiming “suspicious activity,” but it’s really a phishing attempt.

- Marketplace Scams: Scammers pretend to buy or sell items online and send fake payment confirmations.

- Overpayment Scams: A buyer “accidentally” overpays and asks you to refund the difference via Zelle.

- Romance Scams: Scammers build fake relationships online, then request money for emergencies or travel.

- Charity and Donation Scams: Fake organizations ask for quick Zelle transfers after disasters or trending events.

- Prize or Refund Scams: You’re told you’ve won something or are owed a refund—but you must “verify” with payment first.

How to Stay Safe When Using Zelle

The app is secure when you use it carefully and only with people you trust.

Simple precautions can protect your money from scams and fraud. Follow these key steps to stay safe:

- Send Money Only to People You Know: Use Zelle for family, friends, or verified contacts—not strangers or online sellers.

- Double-Check Recipient Info: Always confirm the email or phone number before confirming payment.

- Ignore Urgent or Suspicious Messages: Scammers create a sense of urgency to make you act fast—don’t respond.

- Contact Your Bank Directly: If you receive a “Zelle issue” message, contact your bank through official channels only.

- Use Strong Login Protection: Enable two-factor authentication and biometric login when available.

- Avoid Public Wi-Fi: Don’t access your banking or Zelle app on shared or unsecured networks.

- Update Your App Regularly: Keep your banking and Zelle apps updated for the latest security fixes.

Strengthen Your Password and Login Protection

A weak password makes it easy for scammers to access your account.

Securing your login details is one of the best ways to keep your Zelle and bank information safe. Follow these simple steps to improve your protection:

- Create a Strong Password: Use a mix of letters, numbers, and symbols to make guessing harder.

- Avoid Reusing Passwords: Don’t use the same password for Zelle, email, and other apps.

- Change Passwords Regularly: Update your login details every few months for extra safety.

- Enable Two-Factor Authentication (2FA): Add an extra step, like a code or biometric check, before login.

- Keep Your Password Private: Never share it with anyone, even if they claim to be from your bank.

- Use a Password Manager: Store and generate strong, secure passwords instead of writing them down.

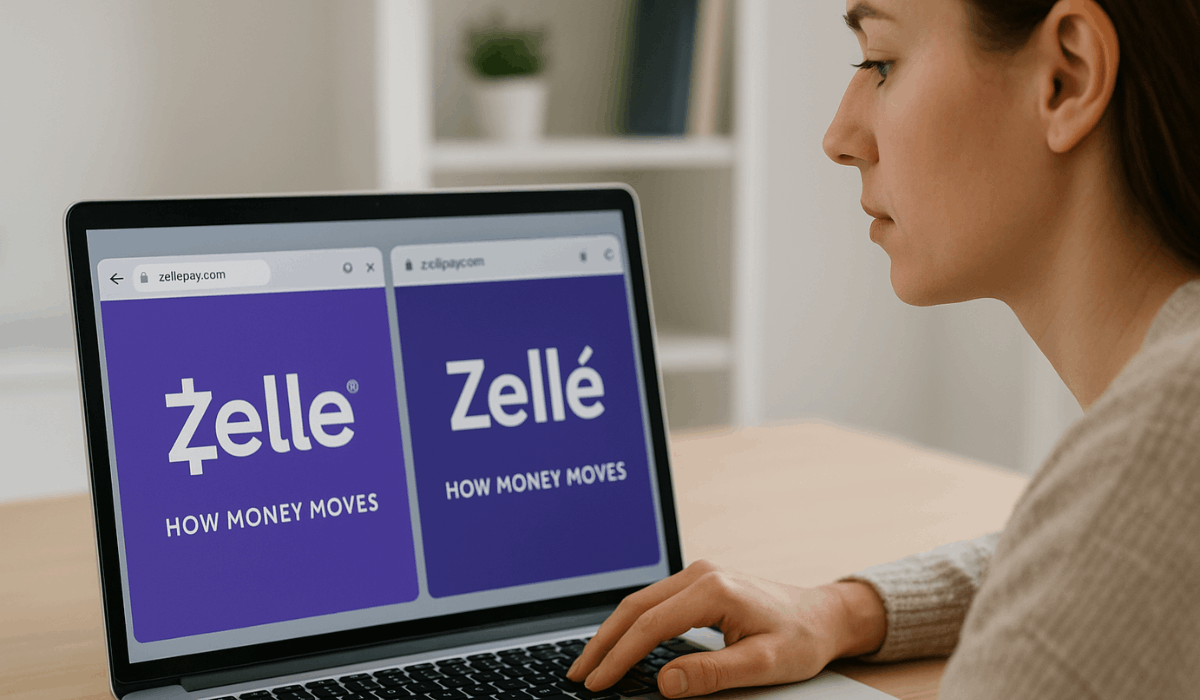

Recognizing Fake Zelle Websites and Emails

Scammers often create fake pages and emails that appear to be official banking services.

Knowing how to spot these traps helps you avoid phishing attempts and identity theft. Keep these points in mind when checking messages or links:

- Check the Web Address: Make sure the site ends with your bank’s official domain or zellepay.com.

- Avoid Clicking Random Links: Never open links from unknown texts or unsolicited emails.

- Look for Spelling Errors: Fake pages often have typos, poor grammar, or low-quality images.

- Ignore Urgent Warnings: Messages claiming “your account will be locked” are often scams.

- Use Bookmarked Links: Access your banking or payment site only through saved, verified pages.

- Verify with the Source: When in doubt, contact your bank through its official app or customer service number.

Protecting Your Linked Bank Account

Your payment account is directly connected to your bank, so keeping it secure is essential.

Simple habits can help prevent unauthorized access or suspicious transfers. Follow these key steps to protect your funds:

- Enable Account Alerts: Turn on text or email notifications for every transaction.

- Review Statements Often: Check your account history weekly for unusual activity.

- Limit Transfer Amounts: Set lower transfer limits to reduce potential losses.

- Use Secure Devices Only: Access your bank or payment app on personal, trusted devices.

- Report Issues Quickly: Contact your bank immediately if you spot any unauthorized charges.

- Keep Banking Apps Updated: Install updates to strengthen security and fix vulnerabilities.

What to Do If You Suspect Fraud

If you think your account has been compromised, acting fast can minimize the damage.

Don’t ignore suspicious activity or unusual messages. Here’s what you should do right away:

- Contact Your Bank Immediately: Report the issue to your bank’s fraud department as soon as possible.

- Freeze or Lock Your Account: Ask your bank to stop transfers until the issue is resolved temporarily.

- Save All Evidence: Keep screenshots, texts, and emails related to the fraudulent activity.

- Change Your Passwords: Update login credentials for your banking and email accounts.

- File a Complaint: Report the fraud to the FTC, Consumer Financial Protection Bureau, or your local authority.

- Monitor Your Statements: Check for more unauthorized transactions in the following days.

Tips for Preventing Future Zelle Scams

Staying alert is the best defense against fraud. Even experienced users can fall for new tricks, so ongoing caution matters.

Follow these tips to reduce your risk in the future:

- Stay Informed: Keep up with new scam alerts shared by your bank or payment service.

- Review Transactions Regularly: Check your account for unusual activity every few days.

- Never Share Verification Codes: Banks and support agents will never ask for these.

- Educate Family Members: Teach others—especially seniors—about common online frauds.

- Use Strong Device Security: Keep your phone locked and protected with biometrics or PINs.

- Trust Your Instincts: If something feels off or too urgent, stop and verify before sending money.

Conclusion – Stay Smart and Protect Your Money

Using digital payment tools is safe when you stay alert and follow basic precautions.

Always verify who you’re sending money to and secure your login details.

Share these Zelle safety tips with friends and family to help them protect their accounts from scams and fraud.